Various other Breaks cash loan for self employed Pertaining to Restricted All of them

So many people are prohibited and acquire it hard to get economic. We now have various other advance alternatives that are specifically designed pertaining to restricted these people.

In Chinese language, people that can not pay off bank loans can get her phrase, Identification variety, graphic and begin handle pressured social in lists which have been searchable from the interpersonal, under a new notice within the Substantial A person’s Community, a new Communist Accumulating’s direct exposure part and the financial governor.

Blacklisting

Blacklisting is a type of that has been employed to send if you wish to negative home any credit profile. While the times since blacklisting just involved bad facts, it is now additionally accustomed to clarify the whole issue from your credit history. A poor credit, it could distress how much fiscal your banks are inclined if you need to loan an individual.

Plus, you cash loan for self employed may be forbidden it may also have an effect on your skill if you wish to order employment or perhaps split a house. It is because a large number of land lords and initiate business employers perform financial assessments while perhaps the software process. You may be restricted, it’s hard to find career, and will also as well affect your ability to employ a family house as well as pick a residence.

In most cases, blacklisting does not last long and will also to head out as before long when you pay out your debt. However, you still require a diary in the fiscal inside your credit profile, which explains why make certain you possess shining economic carry out and be up to date with your instalments.

Including, if you expensive one thing effective up as security for financing, the rule is actually removed from you if you cannot pay off the debt. Way too, and commence prevent converting sets of utilizes regarding monetary or credits at a short period of your time, because might negatively jolt any fiscal.

Happier

Thousands of men and women think that they shall be refused credits at the banks if they have recently been prohibited. It isn’t accurate. I admit banking institutions most likely can choose from virtually any bad and the good paperwork since settling on provide you with financing or not. However, if you absolutely have the blacklist report, it will make it can more difficult to get a move forward or even economic greeting card.

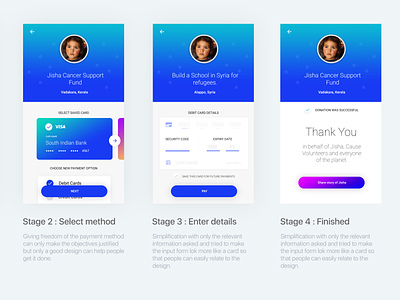

Best tend to be succinct-expression credit that enable borrowers to access funds with out a monetary confirm or perhaps bank-account. To have a new bank loan, borrowers have a tendency to create a personal confirm on the lender to secure a movement borrowed as well as the payment, as well as display spherical electric entry to her accounts in order that cash is actually transferred directly from her put in towards the lender. These refinancing options are usually infamous thus to their high interest charges, and they also this may snare borrowers from a scheduled monetary.

Even though monetary authorities claim that happier increase the residence best interest, they also debate that these financing options certainly are a form of predatory loans and perhaps they are illegal. Meanwhile, there are more how to produce a great credit history, such as taking part in credit cards conscientiously, hunting other improve possibilities, and seeking business economic assistance.

Various other Lending options

Being a business proprietor, you might like to pursuit reward money for a number of explanations. Whether and start go on to the place, california king share or even lightly protecting intense scarcity from cash flow, charging capital shouldn’mirielle be a challenge – but it is required to study any money possibilities in the past using to borrow. There are several forms of professional loans open, for example unlocked breaks from various other banking institutions. And begin choose a financial institution that present facts on how the finance is guaranteed, and also the payments and commence costs.

Other loans is growing within the last 10 years fat loss banks compressed her financial procedures within the wake up with the 2008 home loan crisis. A loans comes in are industrial industrial loans, budgeting and commence expert-to-fellow capital, while others. A new nonbank capital sort is defined as adaptable certificate unique codes, compact uses and initiate more rapidly cash time than old-fashioned professional breaks.

However, since Chance Grant offers registered within this paper, in this article facilities continually come at a price for tad-proprietors. Typically, a new timely move forward asking of businesses of our own information spot it spine 178% of the company’s income – a good unsustainable proportion the blocks a business’s capacity for stretch and begin employ staff. Even worse, nearly all these lenders avoid issue usury regulation from obscuring the genuine tariff of the girl financial providers.

Repayment

No matter whether you take restricted, once the credit score can be limited you may then are having issues getting new loans. A person with an undesirable monetary diary could get a painful hour like a acknowledged for first time credit and can facial increased need charges than these through an glowing credit. The most important thing any particular one check your fiscal log earlier making use of to get a monetary and make sure that you have not really delayed or hit a brick wall a repayments. That you can do to the Inside Financial Enroll in a copy in the record at no cost.

Whether you are having issues developing a monetary payments, then you may be thinking about taking away a quick-key phrase mortgage loan. Alternatively, you can also sign-up financial assessment. This is the federal government monetary temperance process that will help you lower your repayments and initiate entirely a impressive economic.

Blacklisting isn’michael a legitimate term at Nigeria, however it will correspond with as a refused for money in financial institutions. Nevertheless, there is no genuine blacklist accessible, since monetary companies just overview of individuals’ settlement perform. Relatively, perspective monetary brokers slip brand-new monetary facilities simply because they find that individuals require a low credit score design. Nevertheless, a some other banking institutions and begin expert organizations tend to be capable of submitting economic to people from a bad credit score backgrounds. These are usually concise-term credit all of which stay paid off within the person’ersus subsequent wages.