Batch-Level Activities: Meaning, History, Examples

It enables a systematic review of activities that will help pinpoint opportunities for cost control and reallocation of capacity to higher yielding products. In fact, ABC is no better than the process used to identify activities and cost allocations. As an activity-based costing example, consider Company ABC, which has a $50,000 per year electricity bill. For the year, there were 2,500 labor hours worked; in this example, this is the cost driver.

Human Capital Management: Understanding the Value of Your Workforce

Moreover, other stakeholders like investors, suppliers, and community members also appreciate this transparency. It indicates good governance and business integrity, enhancing the company’s reputation. Consequently, a high reputation score can provide access to further capital, better supplier agreements, and overall community support.

AccountingTools

If none of those is a viable option, we might consider dropping the product from our product line. The top portion of the following analysis applies the per-activity cost information to show how the total cost of CAPlayer is less than the total cost of GLASSESong. The lower portion compares costs and revenues to determine product profitability.

- Moreover, other stakeholders like investors, suppliers, and community members also appreciate this transparency.

- Of the total costs, direct material and direct labor were traceable directly to the product cost object.

- Finally, ABC alters the nature of several indirect costs, making costs previously considered indirect—such as depreciation, utilities, or salaries—traceable to certain activities.

- An example of a customer-level activity is general technical product support.

- First, it expands the number of cost pools that can be used to assemble overhead costs.

- In cost accounting, the activity base plays a crucial role in determining costs accurately by allocating overhead costs systematically.

How Activity-Based Costing (ABC) Works

The use of an activity base in sustainability reporting can make a significant difference when it comes to highlighting an organization’s resource consumption. An incorrectly chosen activity base could lead to data misrepresentation, hindering the goal of producing credible sustainability reports. Beyond the orientation towards sustainable business practices, an activity base has further implications for how a business interacts with its stakeholders, which is central to the broader concept of CSR.

Capital Rationing: How Companies Manage Limited Resources

For instance, consider a manufacturing firm that identifies energy use as an activity base. Splitting energy costs per product unit with ABC can expose high energy-consuming activities. With these insights, the company could invest in energy-efficient machinery or technology, effectively reducing energy consumption and decreasing their carbon footprints. This sustainability action aligns precisely with an exemplary environmental responsibility mandate, a pivotal component of CSR.

Variations of Activity-Based Costing (ABC)

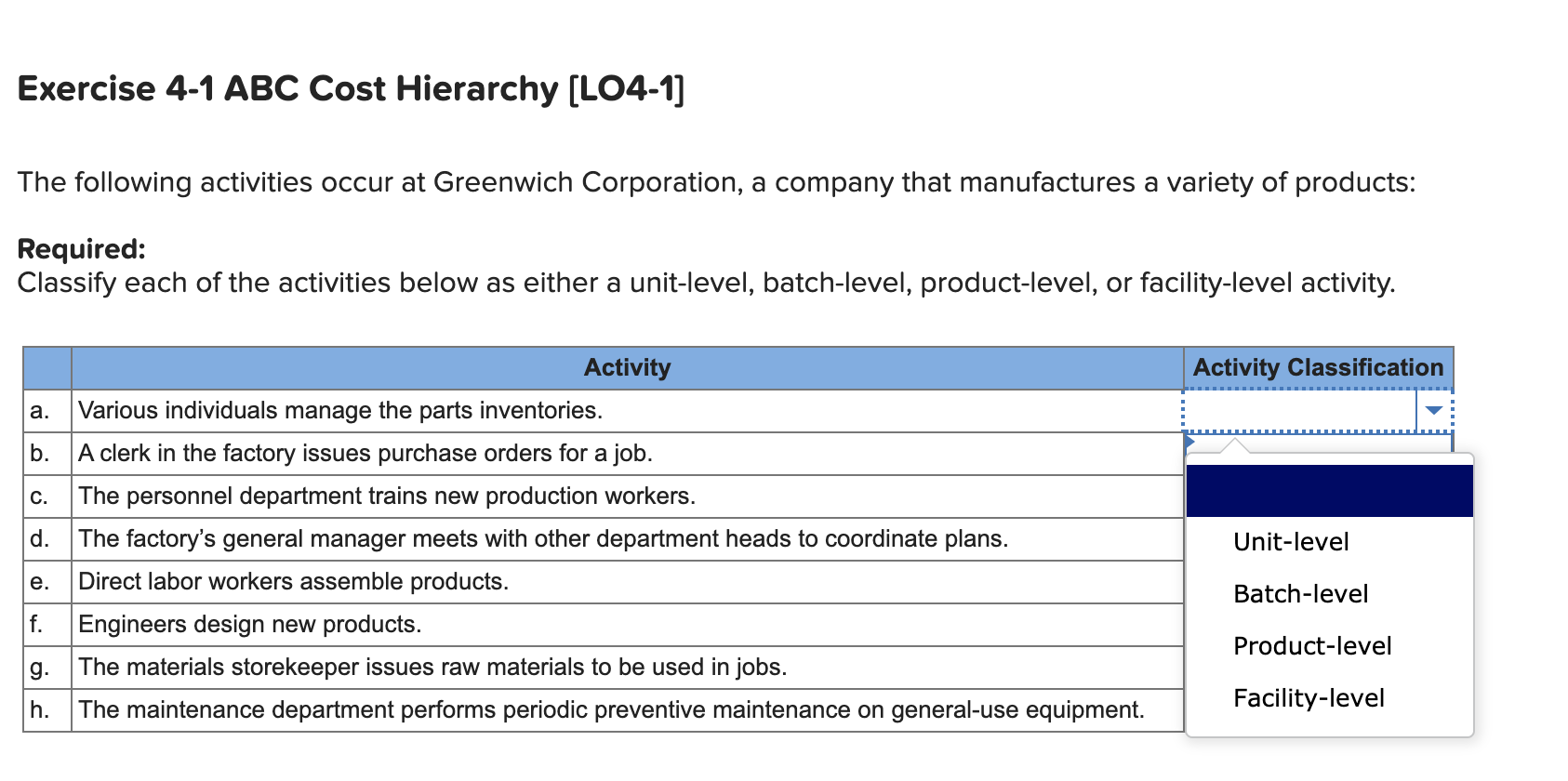

This can inform them about which cost drivers are the most relevant to their specific situation. Implementing an activity base involves substantial complexity and management effort. Companies need to identify cost events, determine their cost drivers, gather relevant data, and update this information batch-level activity periodically. Unit level activities are activities that are performed on each unit of product. Batch level activities are activities that are performed whenever a batch of the product is produced. Product level activities are activities that are conducted separately for each product.

Each cost driver will have its own overhead rate, which is why ABC is a more accurate method of allocating overhead. The cost structure of your business should also be a primary determinant when choosing an activity base. A company with high direct labor costs might opt for ‘labor hours’ as their activity base, as it would provide the most meaningful data for cost allocation and efficiency evaluation. In contrast, a business with high machinery operation costs might lean towards ‘machine hours’ or ‘units produced’ as more relevant activity bases. An “activity base” refers to a specific measure of activity that is used in activity-based costing, an accounting method that identifies and assigns costs to overhead activities and then assigns those costs to objects.

For instance, service-focused businesses might choose ‘hours worked’ or ‘number of clients served’ as their activity base as these metrics directly relate to their central operations. Manufacturing businesses, on the other hand, may choose ‘units produced’ or ‘machine hours’ to remain in line with their production-focused activities. The fact that ABC is not GAAP usually means that a company that wishes to benefit from ABC must develop one costing system for external reporting and another for internal management. Another disadvantage of ABC is that it is usually more involved than other approaches. Rather than applying all factory overhead on some simple basis such as labor hours, it requires the development of numerous cost pools that must be individually allocated.