Best Accounting Software for Small Businesses

To become a certified accountant and help small businesses and organizations with their accounting needs, you’ll need to qualify. That means getting a relevant degree and experience and taking the Certified Public Accountant (CPA) exam to advance your career. Consider the Online Masters of Accounting (iMSA) offered by the University of Illinois Urbana-Champaign.

What is the difference between ERP and accounting software?

Implementing new accounting software can be a major project—even for a company with only a handful of employees. Before buying your software, talk with your current software users about what they see as the most important features. Make note of what processes are currently being done by hand or in spreadsheets that might be easier in a new accounting platform. We believe that conducting business with clients on the go is easier when you have a powerful mobile app. However, that’s not the only thing Zoho Books can offer as it’s also remarkable in other aspects, such as inventory and project accounting. It has features similar to QuickBooks Online—but at a more affordable price.

What is a small business accountant?

No matter which you opt for, you’ll want to select someone who has plenty of experience with the type of small business you have and who you feel comfortable sharing sensitive information with. If you generate (or expect to generate) a lot of invoices to send to clients, we recommend that you find a comprehensive accounting application with invoice-generating features. Freelancers should consider using accounting software that can generate invoices. If you’re a consultant or your business bills clients by the hour, you need accounting software that allows you to track and bill your time or that integrates with the time-tracking program you already use. This is an important feature in the best accounting software for freelancers.

- The Introduction to Spreadsheets course will help students become proficient in using spreadsheets to analyze business problems.

- Our favorite QuickBooks Online features that we tested are its customizable dashboard, comprehensive reporting tools, and accountant and bookkeeper integrations.

- You can use this information to make decisions about pricing, inventory, expenses, investments, and growth for your business.

- You should hire an accountant when the tracking, analysis and reporting of all the financial information related to your business are too complicated or overwhelming for you.

Best Budget: Wave Accounting

You can learn more about record retention periods in our guide to small business recordkeeping. Make sure to consult with a CPA before settling on the method you’ll use. For instance, if your corporation was on the hook for a sum of money, the corporate veil would prevent you from being held personally liable for the debt. Call ahead and ask what paperwork you need to bring to your initial appointment before meeting with a representative of the bank. A CPA can also help you make long-term, big picture financial decisions about the future of your business. If you’re serious about growing and (eventually) selling your business, you need to team up with a Certified Public Accountant (CPA) early on.

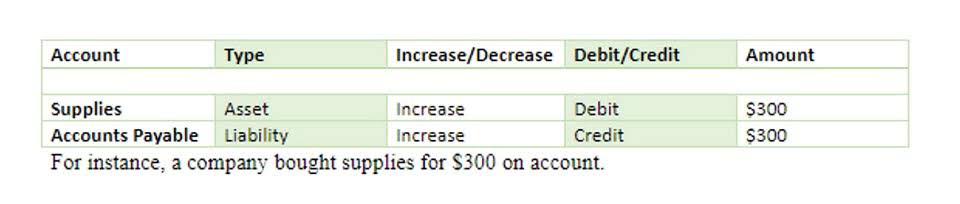

The Basics of Small Business Accounting: A How-to

Two, Wave (free except for a $8 per month charge for scanning receipts) and TrulySmall Accounting ($20 per month), are best for microbusinesses, like independent contractors, freelancers, and sole proprietors. Each has multiple tiers of service to meet the needs of businesses that vary in size and functionality. If you are a small business owner, you know the last three years have been brutal. You survived the worst of the COVID-19 pandemic only to be slammed with crippling supply chain issues. You’ve had to focus more closely than ever on money coming in and going out. Small business accounting software can help you make smarter and better-informed plans for an uncertain future by organizing and automating your daily financial tasks.

Know where your money is going

Some common tax deductions include the cost of goods sold, employee pay and benefits, auto maintenance, travel expenses, marketing and advertising, etc. The accounting tips for small businesses can help you figure out long-term goals, ride financial ups and downs and increase your profits. Moreover, efficient bookkeeping strategies can help you stay out of trouble with the IRS.

Remember, the best accounting solution is the one you’ll consistently use. To open any kind of business bank account, your business needs to be registered with the state in which you are operating, and have a registered business name. You can now customize your FreshBooks experience with a range of business-friendly apps. Take control of your business accounting with the help of these integrations.

- You’ll know it’s time to start looking for new small business accounting software if you start to find that your current software doesn’t offer the features that you need to run your business effectively.

- Look at tuition costs, accreditation, educational models, and coursework to figure out which program is best.

- Implementing systems and best practices for keeping track of expenditures and revenues is key to managing cash flow.

- But micro-businesses may find their needs more affordably met by Xero, and self-employed individuals will appreciate the ability to categorize personal and business expenses with QuickBooks Solopreneur.

- I still do a shocking amount of bookkeeping, invoicing, and other financial tasks for my business with manual spreadsheets and processes.

- When you stay on top of your bookkeeping and accounting processes, you empower yourself to make wise financial decisions.

- Accounting Information Systems (AIS for short) introduces students to AIS, with particular emphasis on the accountant’s role in management and financial reporting systems.